To figure out your conversion cost, the formula is simple: Total Marketing Spend ÷ Number of Conversions. This number, often called Cost Per Acquisition (CPA), tells you exactly what you're paying for a single customer to take a specific, valuable action—like making a purchase or booking a call.

What Is Conversion Cost and Why Does It Matter?

At its heart, conversion cost is the price you pay for one successful outcome. It takes your abstract marketing budget and turns it into a hard performance metric, showing you if your investments are actually making you money. Without this number, you’re basically spending in the dark, with no real way to tell a winning campaign from a money pit.

Understanding this metric is non-negotiable, especially for luxury and service brands where every single client interaction carries significant weight. It helps you answer the tough questions that directly impact your profitability:

- Are my Instagram ads actually generating profitable sales, or are they just expensive clicks?

- Is my Google Ads campaign for local consultations bringing in new clients at a cost that makes sense for my business?

- Should I double down on email marketing or move that budget over to SEO?

Defining the Key Inputs

To get a number you can trust, you have to be crystal clear on both sides of the equation. "Total Cost" isn't just your ad spend; it includes all the variable expenses tied to that campaign, like content creation fees or affiliate payouts. And "Conversions" are the specific, valuable actions you want users to take.

For a high-end retailer, a conversion is almost always a completed sale. But for a service provider, it could be a booked consultation or a submitted contact form. A strong, conversion-focused website design is absolutely essential for turning casual visitors into these valuable leads.

Before you can calculate anything, you need to gather the right data. Here’s a quick reference for the essential inputs you'll need.

| Component | What It Includes | Example for a Service Business |

|---|---|---|

| Total Marketing Spend | Ad spend, content creation costs, freelance fees, affiliate commissions, software subscriptions. | $2,500 spent on a Google Ads campaign targeting local clients. |

| Number of Conversions | The specific, valuable actions you are tracking (e.g., sales, leads, form submissions). | 50 qualified leads generated from a "Book a Consultation" form. |

Getting these inputs right is the foundation for an accurate conversion cost. Once you have them, the calculation itself is straightforward.

This clarity is everything. If your definitions are vague, your data will be misleading. You could end up scaling a channel that's secretly losing you money or cutting a campaign that was delivering your best long-term customers.

Let's look at a quick example. A luxury skincare brand spends $5,000 on an ad campaign that results in 500 sales. Their conversion cost is a clean $10 per purchase.

As you can see, the basic math is simple. In the competitive luxury retail space, top performers often aim to keep these costs under $15-$20 per conversion, using this metric as their guide to scale winning campaigns and optimize their ad spend.

A Practical Guide to Calculating Your Conversion Cost

Alright, let's move from theory to practice. Figuring out your conversion cost is actually pretty straightforward once you get your numbers in order. This simple calculation is your first real step toward understanding how efficiently your marketing is working and where your money is really going.

It all starts with getting a complete picture of your total investment.

Gathering Your Data

To get an accurate conversion cost, you need to tally up every single expense tied to a specific campaign. This is more than just your ad spend. Be sure to include costs for creative work, any software or tools you used, and fees you paid to agencies or freelancers. If you forget these "soft" costs, you'll end up with a number that looks great but is completely misleading.

Once you have your total costs, the next step is to count your conversions—and be precise about it. For a luxury brand, a conversion is usually a completed online purchase. But for a service business, like a high-end home contractor, it’s more likely a qualified lead from a website form.

Let's walk through a real-world scenario. Imagine a luxury home contractor ran two different marketing initiatives last month:

- Google Ads Campaign: They spent $3,000 on ads and another $500 on agency management fees. That’s a total of $3,500. This campaign brought in 10 qualified project leads.

- Local SEO Campaign: They invested $1,500 in content and optimization services, which resulted in 5 qualified project leads.

Calculating at Different Levels

With this data, we can start crunching the numbers. The trick is to look at performance from a few different angles—both campaign-wide and channel-specific—to see what's really happening.

First, let's look at the big picture. The total spend was $5,000 ($3,500 from Google Ads + $1,500 from SEO), which generated 15 leads in total. Using the simple formula (Total Cost / Total Conversions), the overall conversion cost comes out to $333.33 per lead.

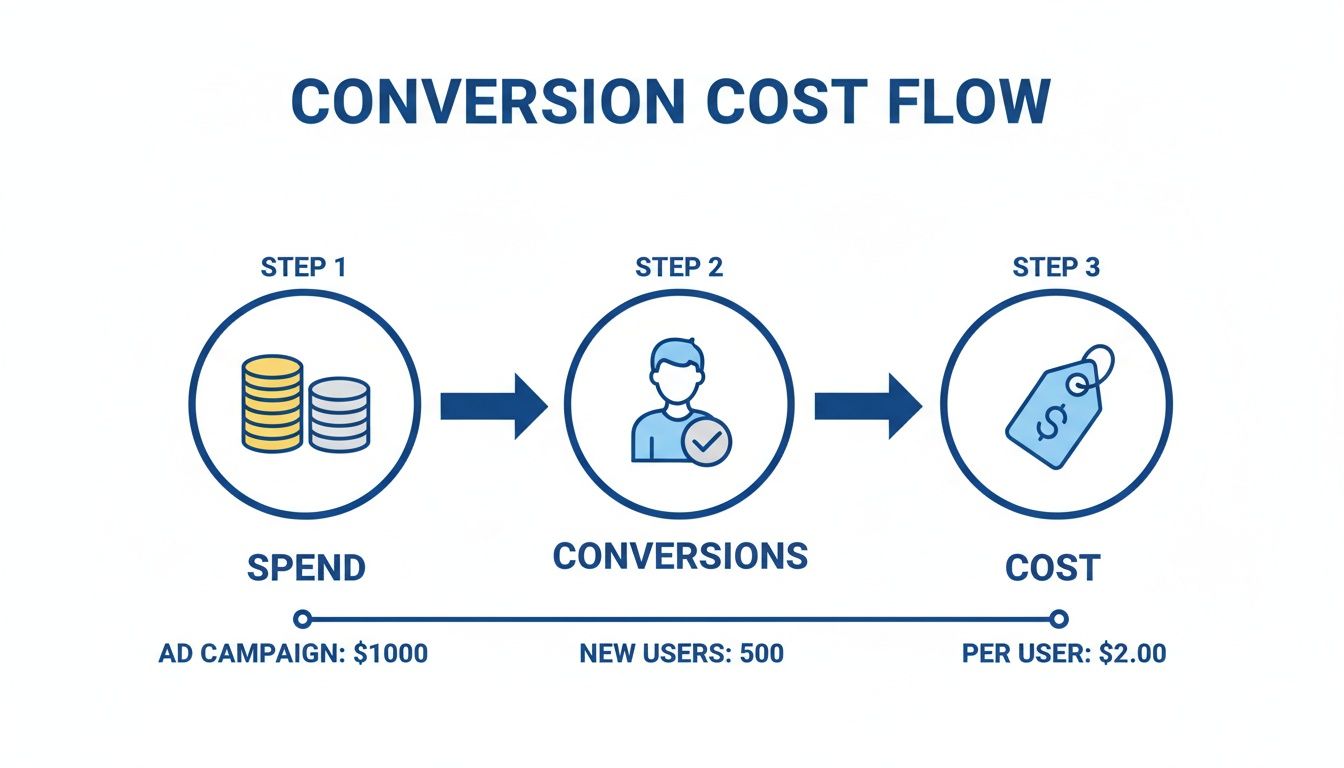

This flowchart breaks down how your spend and conversions come together to give you that final cost.

This visual just reinforces the idea that every dollar you spend has to be justified by the valuable actions it drives.

But a blended average can hide crucial details. Breaking the numbers down by channel reveals a much more actionable story.

When we analyze each channel on its own, here's what we find:

- Google Ads Cost Per Lead: $3,500 / 10 leads = $350

- Local SEO Cost Per Lead: $1,500 / 5 leads = $300

This granular view immediately tells us something important. The SEO efforts, while bringing in fewer leads, are acquiring them more cheaply. This is exactly the kind of insight that helps you make smarter decisions about where to put your budget next quarter.

To get an even broader view of your acquisition metrics, it's also worth learning how to calculate Cost Per Acquisition (CPA), which is a very closely related metric.

Thinking Beyond the Basic Cost Per Conversion

Knowing your basic conversion cost is a great start, but honestly, it’s just one piece of the puzzle. For businesses with high-value customers and long-term relationships—think luxury brands or B2B services—a low initial cost isn’t always the ultimate goal.

In fact, I've seen plenty of scenarios where a higher cost per acquisition (CPA) was incredibly profitable because it brought in the right kind of customer.

A simple CPA calculation treats every conversion the same. It can’t tell the difference between a one-time discount shopper and a loyal brand advocate who will return for years. This is where you need to get more sophisticated with your metrics to make genuinely strategic decisions.

Integrating Customer Lifetime Value

The most powerful metric to pair with your conversion cost is Customer Lifetime Value (LTV). Simply put, LTV predicts the total revenue you can expect from a single customer over the entire time they do business with you.

When you know what a customer is worth in the long run, you can justify spending more to acquire them upfront.

For example, a luxury skincare brand might discover their average customer spends $1,500 over three years. All of a sudden, a $100 CPA doesn't just look acceptable; it looks like a fantastic investment. This simple shift in perspective moves you from short-term tactics to long-term growth.

This brings us to a crucial calculation for sustainable growth: the LTV to CPA ratio.

A healthy business model typically aims for an LTV to CPA ratio of at least 3:1. This means for every dollar you spend acquiring a customer, you get at least three dollars back over their lifetime. A ratio below this suggests you might be overspending, while a higher ratio signals a highly efficient marketing engine.

How Attribution Models Change Everything

Another layer of complexity is your attribution model—the rule that decides how credit for a conversion gets assigned to the various touchpoints in a customer's journey. The model you choose can drastically change how you calculate conversion costs for each channel, which directly impacts your budget decisions.

Let's look at how different models would assign credit for a single sale:

- First-Touch Attribution: Gives 100% of the credit to the very first interaction, like an initial blog post they found on Google. This model often makes top-of-funnel channels like SEO and content marketing look like superstars.

- Last-Touch Attribution: Assigns 100% of the credit to the final touchpoint before the sale, such as a retargeting ad or a branded search click. This is the default for many platforms and tends to give all the glory to bottom-of-funnel channels like Google Ads.

- Multi-Touch Attribution (e.g., Linear): Spreads the credit evenly across every touchpoint. This provides a more balanced view but can be more complex to set up and interpret.

Imagine a customer first discovers your brand via an Instagram ad, later clicks a retargeting ad on Facebook, and finally makes a purchase after a direct search. Last-touch attribution would assign a low conversion cost to search and give $0 value to that initial Instagram ad.

This could easily lead you to mistakenly slash your Instagram budget, cutting off the very channel that introduced you to some of your most valuable customers in the first place.

By understanding these nuances, you move beyond a surface-level analysis. You start to see the full picture, ensuring you're investing in channels that drive not just immediate sales, but sustainable, long-term profitability.

How Conversion Rate Optimization Reduces Acquisition Costs

Lowering your conversion cost isn't just about finding ways to slash your ad budget. It's about getting more value out of every single visitor you've already paid to attract. This is where Conversion Rate Optimization (CRO) comes in, and it's one of the most powerful levers you can pull for profitability.

The relationship is simple: as your conversion rate goes up, your cost per conversion goes down. This holds true even if your ad spend stays exactly the same.

Think of it like this. Your marketing budget brings a certain number of people to your digital doorstep. CRO is the art and science of persuading more of those people to actually step inside and take the action you want them to. Every improvement you make, no matter how small it seems, has a direct impact on your bottom line.

The Math Behind The Magic

Let's walk through a clear example to see how this plays out. Imagine a luxury skincare brand spends $5,000 on a campaign that drives 10,000 visitors to their website.

Initially, their site converts at a modest 2%. This means they generate 200 sales from those visitors. To find their conversion cost, the calculation is straightforward:

- Cost Per Conversion: $5,000 / 200 Sales = $25

Now, let's say they decide to focus on CRO. They run some A/B tests on their product page headlines, simplify the checkout process to remove friction, and optimize the site speed for mobile users. These changes work, boosting their conversion rate from 2% to 3%.

With the same $5,000 ad spend and 10,000 visitors, they now generate 300 sales instead of 200. Let's run the math again:

- New Cost Per Conversion: $5,000 / 300 Sales = $16.67

By lifting their conversion rate by just one percentage point, they slashed their acquisition cost by over 33%. This single improvement completely changed the campaign's financial performance without spending an extra dollar on ads.

This principle is fundamental for any brand that wants to scale efficiently. Below is a table that breaks down just how dramatically small improvements can impact your CPA, even when ad spend is fixed.

How CRO Impacts Your Conversion Cost

See how small improvements to your conversion rate can dramatically reduce your cost per acquisition with a fixed ad spend.

| Ad Spend | Website Visitors | Conversion Rate | Total Conversions | Cost Per Conversion |

|---|---|---|---|---|

| $5,000 | 10,000 | 2.0% | 200 | $25.00 |

| $5,000 | 10,000 | 2.5% | 250 | $20.00 |

| $5,000 | 10,000 | 3.0% | 300 | $16.67 |

| $5,000 | 10,000 | 3.5% | 350 | $14.29 |

| $5,000 | 10,000 | 4.0% | 400 | $12.50 |

As you can see, doubling the conversion rate from 2% to 4% cuts the cost per conversion in half.

Focusing on CRO means you shift from simply buying traffic to building a more efficient conversion engine. This not only makes your current marketing spend more profitable but also allows you to scale your campaigns with much more confidence.

If you're looking for more ways to improve your site's performance, check out our guide on how to increase website conversions.

Actionable Strategies to Lower Your Conversion Cost

Calculating your conversion cost is a great start, but the real magic happens when you start actively pushing that number down. Lowering your CPA is all about making every single marketing dollar pull its weight, driving better results without just throwing more money at the problem. It’s a game of precision and efficiency.

So, let's get into some proven tactics you can use to shrink those acquisition costs while keeping—or even improving—the quality of the leads you bring in.

Refine Your Ad Targeting

One of the fastest ways to burn through your budget is showing ads to the wrong audience. Getting hyper-specific with your targeting ensures your message lands in front of people who are not just interested but actually qualified to buy.

For a luxury brand, this goes way beyond broad demographics. Instead of just targeting "high-income earners," try building lookalike audiences from your existing high-LTV customer lists. This tells platforms like Meta to go find new users who share the same traits as your absolute best clients. A bespoke tailor, for example, could upload a list of their top 200 clients to create a powerful lookalike audience, instantly focusing their ads on people who mirror their ideal customer profile.

Use Negative Keywords Strategically

If you're a service-based business running search ads, negative keywords are non-negotiable. They are your best defense against irrelevant clicks. You add these terms to your campaigns to stop your ads from showing up for searches that have nothing to do with what you offer.

Imagine a high-end home contractor specializing in luxury renovations. They absolutely want to avoid paying for clicks from people searching for:

- "cheap kitchen remodel"

- "DIY bathroom renovation"

- "contractor jobs"

By adding words like "cheap," "DIY," and "jobs" as negative keywords, they stop wasting ad spend on traffic that will never convert. This simple move directly lowers the cost side of the equation when you calculate conversion cost, making every dollar count.

When you pay for traffic, you're paying for potential. Eliminating unqualified clicks ensures that your budget is only spent on traffic with genuine conversion potential, drastically improving your ROI.

Optimize Your Landing Page Experience

Your landing page is where the deal is closed. If the message on that page doesn’t perfectly match the promise you made in your ad, you’re going to see a high bounce rate and a dismal conversion rate. This disconnect means you have to spend more just to get a single conversion.

Make sure your landing page copy, headlines, and images directly reflect the ad that brought the user there. If your ad promotes a "bespoke diamond engagement ring," the landing page better feature exactly that—not a generic jewelry category page. This consistency builds trust and smooths the path to conversion. If you're seeing drop-offs in your funnel, you might be interested in learning how to reduce shopping cart abandonment with targeted fixes.

Deploy Smart Retargeting Campaigns

Hardly anyone converts on their first visit, especially when it comes to high-ticket items or services. That's where retargeting comes in. It lets you re-engage those high-intent prospects who have already checked you out.

Don't just run one generic retargeting ad. Create segmented campaigns based on what people actually did on your site. For instance, someone who viewed a specific product page should see an ad for that exact item. Someone who ditched their cart can get a gentle reminder or maybe a small incentive to finish the purchase. This focused approach is miles more effective than a generic brand ad and almost always delivers a much lower cost per acquisition.

Common Questions About Calculating Conversion Cost

Even when you have the formulas down, real-world questions always pop up. I see it all the time with clients—calculating conversion cost often starts a debate about what's "good," how to track everything properly, and which numbers actually belong in the calculation.

Let's clear up some of the most common points of confusion. Getting these right is the key to making sound business decisions instead of just guessing.

What Is a Good Conversion Cost for My Business?

There’s no magic number here. A "good" conversion cost is completely relative to your business model, profit margins, and how much a customer is worth over time.

For a luxury brand selling $500 handbags, a $40 CPA could be incredible. But for a SaaS company with a $29/month subscription, that same CPA would sink the business fast.

The benchmark that truly matters isn't some generic industry average; it's your LTV to CPA ratio.

As a rule of thumb, a healthy business should aim for a ratio of at least 3:1. This means the lifetime value (LTV) you get from a customer should be at least three times what you paid to acquire them. It's a simple gut check that tells you if your marketing is actually profitable and sustainable.

How Do I Track My Conversions Accurately?

Bad tracking makes every other calculation meaningless. You're just working with bad data.

Your foundation has to be the native tracking tools for the ad platforms you're using. Think the Meta Pixel and the Google Ads Conversion Tag. These are non-negotiable for capturing actions driven directly by your ads.

Beyond that, you absolutely need to set up specific conversion goals in Google Analytics 4 (GA4). Define what matters—a purchase, a form submission, a key page view—and track those events so you can see what’s happening across every single channel, not just paid ads.

If you’re a service business where the real conversion happens offline, bridging that data gap is everything:

- Use call tracking software to link inbound phone leads back to the specific campaign or ad that got them to pick up the phone.

- Integrate your CRM with your analytics. This is how you connect a closed deal all the way back to the initial keyword search or ad click that started the journey.

Should I Include Fixed Costs Like Salaries in My Calculation?

This really depends on what you're trying to figure out.

For day-to-day campaign management, you should stick to variable costs—things like ad spend and maybe creative production fees. This gives you your Cost Per Acquisition (CPA), which is perfect for making direct comparisons between two ads or two channels. It's clean, simple, and gives you actionable feedback on performance.

However, if you need a high-level view of your entire marketing department's profitability, some businesses calculate a "fully loaded" CPA. This folds in fixed costs like marketing salaries and software subscriptions. While this can be useful for annual budget planning, it's not very helpful for making quick, tactical changes to your campaigns.

My advice? Start with the variable CPA. It will give you the immediate insights you can actually act on.

Ready to transform your website from an expense into your primary growth engine? At KN Digital, we specialize in designing and optimizing websites that don't just look good—they convert. Book a free strategy call today and let's build a digital experience that drives measurable results.